Report by Paula Antolini, April 23, 2020, 6:07PM EDT

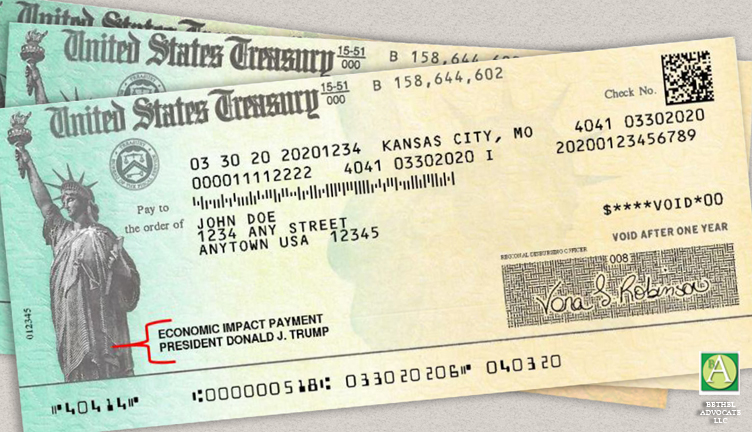

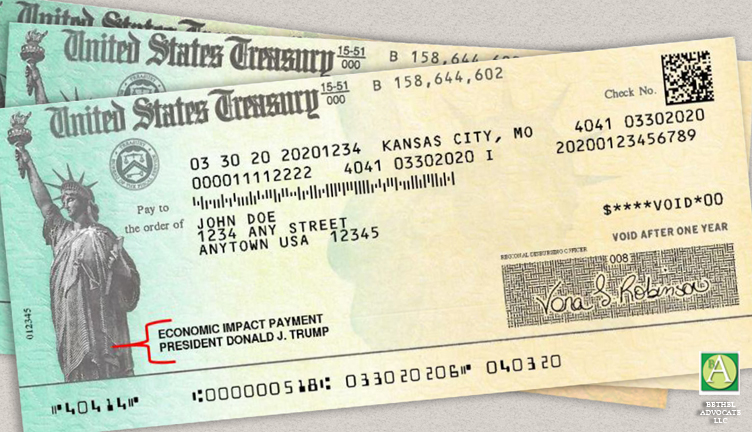

Treasury, IRS unveil online application to help with Economic Impact Payments; Get My Payment allows people to provide direct deposit information and gives payment date

WASHINGTON – Working with the Treasury Department, the Internal Revenue Service unveiled the new Get My Payment with features to let taxpayers check on their Economic Impact Payment date and update direct deposit information.

buy lotrisone online https://buybloinfo.com/lotrisone.html no prescription

With an initial round of more than 80 million Economic Impact Payments starting to hit bank accounts over the weekend and throughout this week, this new tool will help address key common questions. Get My Payment will show the projected date when a deposit has been scheduled, similar to the “Where’s My Refund tool” many taxpayers are already familiar with.

Get My Payment also allows people a chance to provide their bank information. People who did not use direct deposit on their last tax return will be able to input information to receive the payment by direct deposit into their bank account, expediting receipt.

“Get My Payment will offer people with a quick and easy way to find the status of their payment and, where possible, provide their bank account information if we don’t already have it,” said IRS Commissioner Chuck Rettig. “Our IRS employees have been working non-stop on the Economic Impact Payments to help taxpayers in need. In addition to successfully generating payments to more than 80 million people, IRS teams throughout the country proudly worked long days and weekends to quickly deliver Get My Payment ahead of schedule.”

Get My Payment is updated once daily, usually overnight. The IRS urges taxpayers to only use Get My Payment once a day given the large number of people receiving Economic Impact Payments.

buy mestinon online https://buybloinfo.com/mestinon.html no prescription

How to use Get My Payment

Available only on IRS.gov, the online application is safe and secure to use. Taxpayers only need a few pieces of information to quickly obtain the status of their payment and, where needed, provide their bank account information. Having a copy of their most recent tax return can help speed the process.

- For taxpayers to track the status of their payment, this feature will show taxpayers the payment amount, scheduled delivery date by direct deposit or paper check and if a payment hasn’t been scheduled. They will need to enter basic information including:

- Social Security number

- Date of birth, and

- Mailing address used on their tax return.

- Taxpayers needing to add their bank account information to speed receipt of their payment will also need to provide the following additional information:

- Their Adjusted Gross Income from their most recent tax return submitted, either 2019 or 2018

- The refund or amount owed from their latest filed tax return

- Bank account type, account and routing numbers

Get My Payment cannot update bank account information after an Economic Impact Payment has been scheduled for delivery. To help protect against potential fraud, the tool also does not allow people to change bank account information already on file with the IRS.

A Spanish version of Get My Payment is expected in a few weeks.

Don’t normally file a tax return? Additional IRS tool helps non-filers

In addition to Get My Payment, Treasury and IRS have a second a new web tool allowing quick registration for Economic Impact Payments for those who don’t normally file a tax return.

buy micardis online https://buybloinfo.com/micardis.html no prescription

The Non-filers: Enter Payment Info tool, developed in partnership between the IRS and the Free File Alliance, provides a free and easy option designed for people who don’t have a return filing obligation, including those with too little income to file. The new web tool is available only on IRS.gov, and users should look for Non-filers: Enter Payment Info Here to take them directly to the tool.

Non-filers: Enter Payment Info is designed for people who did not file a tax return for 2018 or 2019 and who don’t receive Social Security retirement, disability (SSDI), or survivor benefits and Railroad Retirement benefits. Additional information is available at https://www.irs.gov/coronavirus/non-filers-enter-payment-info-here.

No action needed by most taxpayers

Eligible taxpayers who filed tax returns for 2019 or 2018 will receive the payments automatically. Automatic payments will also go in the near future to those receiving Social Security retirement, or disability (SSDI), or survivor benefits and Railroad Retirement benefits.

General information about the Economic Impact Payments is available on a special section of IRS.gov: https://www.irs.gov/coronavirus/economic-impact-payment-information-center.

Watch out for scams related to Economic Impact Payments

The IRS urges taxpayers to be on the lookout for scams related to the Economic Impact Payments. To use the new app or get information, taxpayers should visit IRS.gov. People should watch out for scams using email, phone calls or texts related to the payments. Be careful and cautious: The IRS will not send unsolicited electronic communications asking people to open attachments, visit a website or share personal or financial information. Remember, go directly and solely to IRS.gov for official information.

More information

The IRS will post frequently asked questions on IRS.gov/coronavirus and will provide updates as soon as they are available.

Support for the State of Connecticut

What resources are provided for Connecticut to support critical efforts in the state to respond to this crisis?

- The law includes $150 billion for a “Coronavirus Relief Fund” to send direct payments to states, tribal authorities, and local governments to help pay for necessary expenditures related to addressing the COVID-19 public health crisis. The state of Connecticut is expected to receive approximately $1.3 billion from this fund.

- There’s also $1.5 billion to support state, local, and tribal public health department activities to be used for medical supplies, surveillance, lab testing, infection control and mitigation. Connecticut is estimated to receive almost $8 million from this fund to support state and municipal activities related to the COVID-19 response.

- This is in addition to $950 million that Congress included in the first COVID-19 appropriations package. The Centers for Disease Control and Prevention provided $7.558 million on March 11 to Connecticut to support the state and local public health response.

*****

Check on the status of your Economic Impact Payment

This application will give you information about:

- Your payment status

- Your payment type

- Whether we need more information from you, including bank account information

You May Need:

- Your 2019 return, if filed, and

- Your 2018 return

Data is updated once per day overnight, so there’s no need to check back more than once per day.

Note: If you receive an SSA or RRB Form 1099 or SSI or VA benefits, your information is not yet available in this application.

Get My Payment Frequently Asked Questions

*****

Direct Payments

How will I know if I am getting a check or not? Do I have to sign up?

- Individuals with adjusted gross income under $75,000 ($112,500 for head of household and $150,000 for joint filers) who are not dependents of another taxpayer are eligible for the full rebate.

- The rebates will be paid out as advance refunds (in the form of checks or direct deposit) based on your 2019 tax returns (or 2018, if a 2019 return has not yet been filed).

- Non-filers will have to file a tax return to qualify, but we are waiting on the IRS to provide more guidance.

- These payments are available to anyone with a Social Security Number (but not an ITIN number), including those who have no income, as well as those whose income comes entirely from non-taxable, means-tested benefit programs, such as Social Security or Social Security Disability Insurance.

- The rebate is treated like other refundable tax credits and not considered income, so it will not be taxed.

How much will I get and when?

- Each eligible adult in a household will receive $1,200 with an additional $500 for each dependent child in the household under 17.

- These payments begin phasing out at a 5% rate for single filers above $75,000, head of household filers above $122,500, and joint filers about $150,000. For example, an individual earning $87,000 per year would receive a payment of $600, and an individual earning $99,000 per year and above would not receive a payment.

The IRS hopes to begin issuing the rebate checks within three weeks.

###